GCF Working Paper 2/2017a:

Framing 1.5 C – Turning an investment challenge into a green growth opportunity

[by S. Wolf, C. Jaeger, J. Mielke, F. Schuetze, R. Rosen] ||

[*This is a slightly amended version of GCF Working Paper 2/2017.] ||

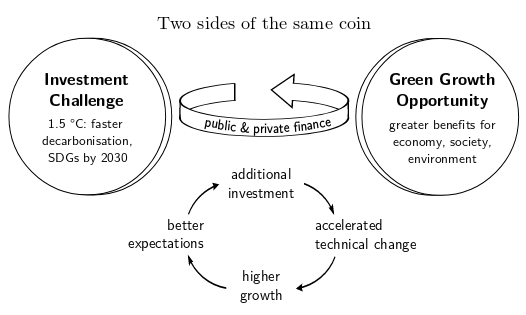

Our new working paper wants to contribute to the special report on the impacts of average global warming of 1.5°C above pre-industrial levels that the Intergovernmental Panel on Climate Change (IPCC) will produce in 2018. In contrast to a classical perspective on climate policy, which focuses on costs, our paper proposes a win-win framing: The 1:5C scenario should be seen as an opportunity for the world to achieve a Great Transition to green growth. Read more

Framing 1.5 C – Turning an investment challenge into a green growth opportunity